Mon-Fri 9am-5pm

Talk to our friendly electric car leasing experts now: 01942 910 001This website uses cookies to ensure you get the best experience. Learn more

Salary Sacrifice - What happens if my employee resigns or has their contract terminated?

Salary Sacrifice - What happens if my employee resigns or has their contract terminated?

The growth of salary sacrifice has not gone unnoticed in the electric car lease world, with many employers (and employees) pursuing this with enthusiasm and purpose, as they look to enjoy significant financial and HR benefits which are associated with this arrangement. But what is salary sacrifice (or Sal Sac) and is it just for electric cars? The definition, according to HMRC is:

“an agreement to reduce an employee's entitlement to cash pay, usually in return for a non-cash benefit. As an employer, you can set up a salary sacrifice arrangement by changing the terms of your employee's employment contract. Your employee needs to agree to this change.”

So the salary sacrifice is not just a bespoke car product, it is something which applies to other arrangements for example bicycles (cycle to work scheme), car parking, gym memberships or childcare vouchers. To do any of this you need to amend an employee’s contract to effect the change, so you should always consult advice as part of this. For an employee, they will agree to give up a fixed amount of their gross salary, before income tax and National Insurance Contributions (NIC), in exchange for the non-cash benefit. And schemes have been in place for some time in the UK in respect of motor cars, it has probably just gone unnoticed until more recently.

As some customers may know there are a number of financial methods for procuring a new vehicle. In our industry, this will be personal contract hire (PCH), business contract hire (company car/fleet) or salary sacrifice. A company car was often see as the big advantage and benefit to have as an employee but, before the revolution of EVs, many schemes were specific to petrol or diesel options.

HMRC have consistently increased the company car tax applicable on company cars, which led to many employees paying considerable tax on their new vehicles - hundreds of pounds a month in many cases. This is what led to the growth of company car allowances, which was an additional sum paid in addition to an employee’s salary in order for them to procure a new vehicle on a PCH basis.

While the employee would have to pay income tax on the gross amount for the company car contribution, there was no company car tax and therefore the emissions of the vehicle or the type of fuel were somewhat immaterial. In contrast, a sal sac arrangement was only relatively popular as this involved a salary reduction for the effective rental (what it costs the employer) of the vehicle BUT as this is considered a benefit this was also subject to company car tax in the same as a BCH customer.

Unless an employee couldn’t access new car finance, because of a bad credit situation, the sal sac of a combustion vehicle just wasn’t financially worthwhile, as you were paying both the rental for the car AND the company car tax on it too.

However, at the point in which HMRC removed Benefit in Kind (BiK) for EVs, i.e. 0%, attitudes in both the company car and salary sacrifice market changed overnight. And while it has slowly increased to the current 2% increment, the Government did confirm this would be the case until 2024/2025 with only a 1% yearly increase thereafter.

This is a beneficial position and has effectively resulted in very cost-effective tax positions on new electric cars. It is no surprise that company car fleets have transferred to the likes of Tesla, Audi, BMW and Mercedes with significant enthusiasm. But EVs are equally enjoyed by retail and consumer customers too, as these represent a positive driving experience, lower running costs and an enhanced environmental impact.

For employees with financial acumen they will have noticed that the overall cost of a salary sacrifice arrangement on an EV is often much cheaper than a like for like PCH or PCP arrangement. Because an employee is using their gross salary for 40% (or higher) tax payers particularly, there is an immediate income tax saving compared to using their net salary to pay privately.

And because EVs attract little company car tax, this is easily offset against the tax savings. And for employers, this has cemented the employee to the business, as an attractive proposition for helping their employees to access cost-effective electric cars. Retaining key staff in the modern employment world is difficult and cost-neutral products like salary sacrifice can really benefit.

What is early termination?

But salary sacrifice is not without consequence, and the employer must undertake careful consideration of the arrangement. The funding product, contract hire, is a fixed term agreement for 2 / 3 / 4 years which must run until the contract cessation.

The contract and finance is organised via the company/employer, so the ultimate risk and responsibility for the vehicle is with them. If an employee should leave their employment due to a job change, ill-health or via termination, the employer will need to organise the BEV to be returned.

This is achieved by asking the select finance company for an early termination (e-car lease are a broker and introduce you / the business to a select number of finance companies). The cost of returning a lease vehicle is often 50% of the remaining rentals, so if you terminate 12 months into a 36 month agreement, you will be asked to pay an amount equivalent to 12 months’ rentals (plus the vehicle is inspected for condition and mileage). This is something we make clear to the employer, as we want them to ensure adequate means of protection have been put in place.

Can you protect against early termination with salary sacrifice?

There are a number of methods which are now in place to minimise the risk. One of the most common methods is for the employer to use the NIC savings that arise with the sal sac arrangement (the employer reduces their NIC exposure to do the sacrifice) to pay for any early termination. Many finance companies quote default of 2-3% within their schemes which means that only 2-3 out of 100 employees are likely to early terminate their cars during the course of agreement.

If the employer retains the NIC savings to effectively self-insure against this risk, this more than covers the termination amount. Research undertaken by Nita Clarke of the Involvement & Participation Association, as highlighted during last month’s BVRLA Leasing Broker Conference, shows that the cost of replacing an employee can be as high as 75% of their annual salary. This is due to a number of factors such as lost sales, recruitment costs, such as agency fees and time lost during the recruitment process, and the cost of bringing a new employee up to speed in their new role.

There are also other means of protection against early termination of a salary sacrifice agreement. Some employers will utilise early termination insurance, which is a cost built into the agreement in order to protect the employer against the cost. Because the insurance forms part of the arrangement - car + maintenance + ET insurance - the amount is fundamentally paid by the employee.

For an employer they do prefer this route to the NIC savings as this places the obligation on the employee at no cost to them. Some finance companies will also offer phased ET policies for a higher rental. By this we mean that the monthly rental from the finance company will be increased, usually by 5-8%, and in return the cost of ET will be reduced over time. For example, the rules of the ET policy would say 50% of the remaining rentals for a termination in the first 6 months with this being reduced to 25% in months 6 - 12 etc Again the cost is passed onto the employee as part of protecting the employer against any costs associated with that employee leaving.

For more information on salary sacrifice and the conditions for both employer and employee, just check our dedicated section

For information on the setting up a scheme or the tax implications, please speak with our advisory team at BCF Wessex / Gensen

And enjoy the pictures of one of our best-selling Sal Sac cars, the Tesla Model 3 Saloon Long Range AWD 4dr Auto Pure Electric Vehicle, which is based on the following configuration:

- Deep Blue Metallic paint

- Premium engineered material - Black seat

- 18" alloy wheels with aero covers

- Type 2 cable

- Tesla mobile connector + domestic adapter (British 3-pin)

What is the range of the Tesla Model 3 LR?

.jpg)

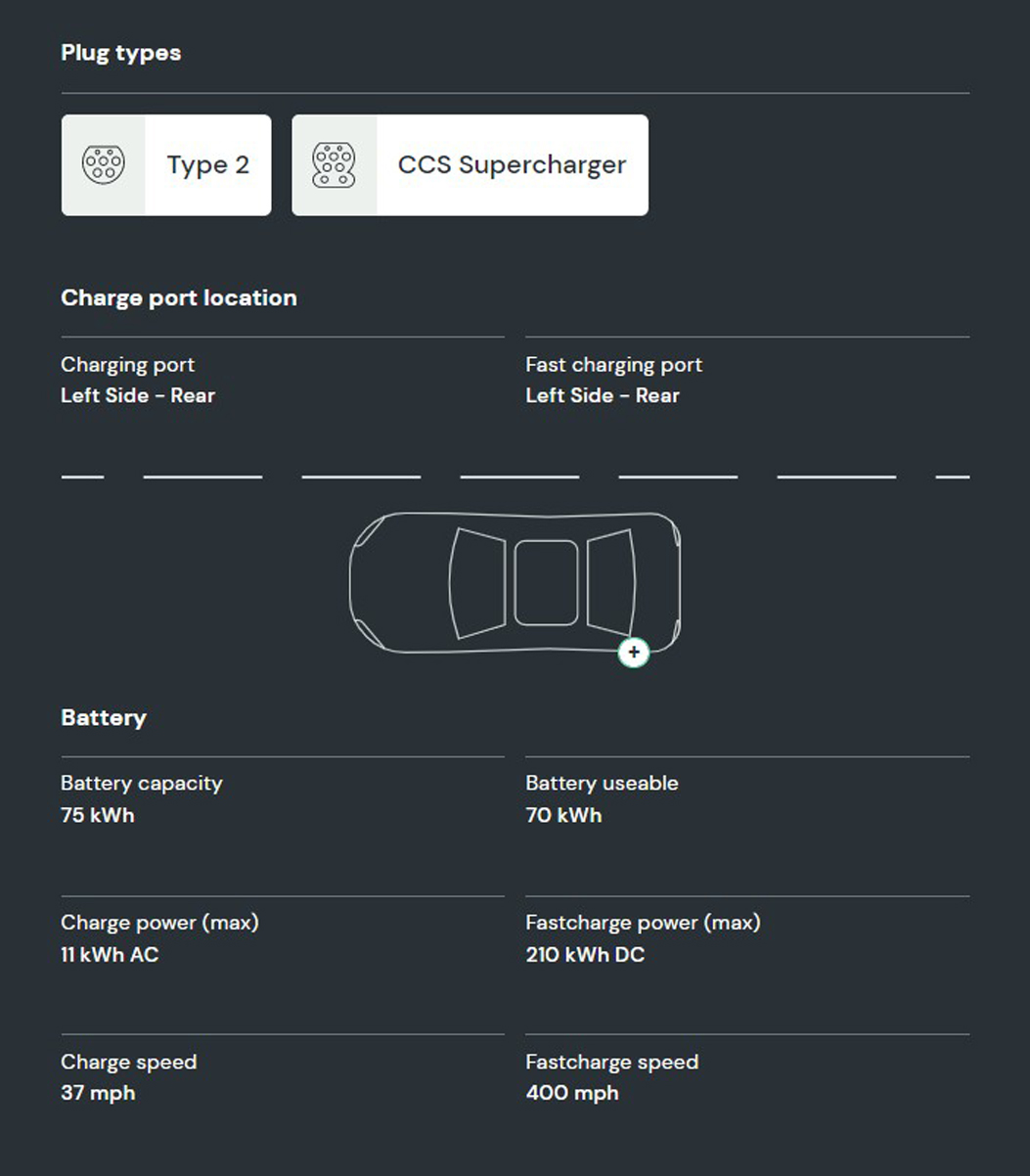

What is the battery capacity and charging speed on the Tesla Model 3 LR?

How long does it take to charge the Tesla Model 3 LR?

.jpg)

Where can I charge the Tesla Model 3 LR?

.jpg)

What is the company car tax on the Tesla Model 3 LR?

.jpg)

e-car lease work alongside these select finance companies:

e-car lease have a partnership and affiliation with:

Register & get new deals weekly

Exclusive offers

Exclusive offers

Electric-only deals

Electric-only deals

Never miss out

Never miss out

Talk to one of our experts

01942 910 001 Email usLeasing

© Copyright 2025 e-car lease. All rights reserved. e-car lease is a trading name of CarLease (UK) Ltd, e-car lease is a credit broker and not a lender. We are authorised and regulated by the Financial Conduct Authority. Registered No: 706617. BVRLA Membership No. 1471. Registered in England & Wales with Company Number: 09312506 | Data Protection No: ZA088399 | VAT No: 200422089 | Registered Office: Kings Business Centre, Warrington Road, Leigh, Greater Manchester, WN7 3XG

Made by morphsites®